Articles / Will a tax on sugary drinks actually help prevent T2D?

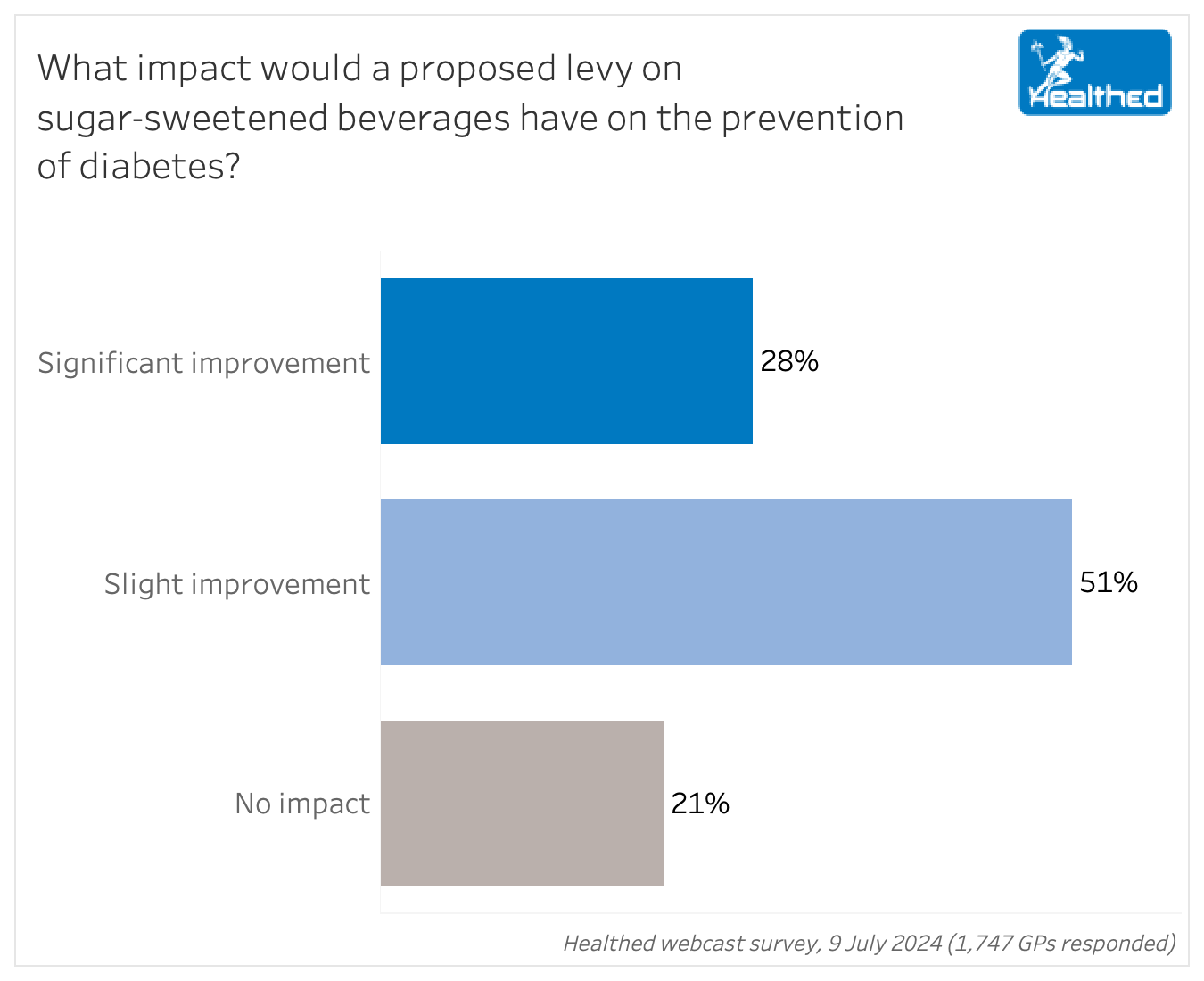

While more than three quarters of GPs believe a levy on sugar-sweetened beverages would have some impact on preventing type 2 diabetes, 51% feel the policy will only lead to a slight improvement—while 28% say it would significantly improve things. The remaining 21% don’t think it would have any impact at all, according to Healthed’s latest survey of 1747 GPs across Australia.

The survey follows the recommendation from the federal parliamentary inquiry into diabetes earlier this month to institute a tax on all sugar-sweetened beverages.

“The Committee recommends that the Australian Government implements a levy on sugar-sweetened beverages, such that the price is modelled on international best practice and the anticipated improvement of health outcomes. The levy should be graduated according to the sugar content.” – Recommendation 4 from the State of Diabetes Mellitus in Australia in 2024 report

The Australian Medical Association and the Public Health Association of Australia have both pushed for a 20% levy, which is what the Parliamentary Budget Office based its costings on. (Meanwhile the Grattan Institute proposed a scheme where drinks with the highest sugar content would increase by 12% on average—and drinks with less than 5 grams of sugar per 100ml would have no tax applied.)

The report notes that despite considerable support, the effectiveness of a levy on sugar-sweetened beverages “remains contentious.”

Professor John Dixon, Vice President of the National Association of Clinical Obesity Services and an adjunct professor at Iverson Health Innovations Institute at Swinburne University is not so optimistic about its potential benefits.

“This idea has been around for many years and has been tried in many countries. The results show decreased sugar sweetened beverage consumption, but no change in BMI for children or adults. The only positive effect on BMI was in adolescent girls in Mexico and the effect was trivial. Many countries, including Australia, have reduced sugar consumption over recent decades, and obesity rates have continued to rise,” Professor Dixon says.

“Today the enemy is ultra-processed foods as a major cause of obesity, but to date defining and addressing UPF has not yet been shown to be helpful. We will see over the coming years if this provides benefit.”

Professor Dixon also believes the policy disproportionately impacts people from lower socioeconomic backgrounds and contributes to stigma.

“The unfortunate downside of these public health measures is that they act as a greater tax burden on the poor. And reinforces the message that obesity is driven by poor individual choices. It perpetuates weight stigma.”

Others, such as Associate Professor Samantha Hocking, an endocrinologist at the Royal Prince Alfred Hospital and a clinical academic at the University of Sydney, are more cautiously optimistic that a levy *might* play a role as part of a broader, multifaceted approach.

She points to this 2024 critical review which found “a substantial body of evidence that sugar-sweetened beverage (SSB) taxes lead to increased prices and subsequent reduced consumption, with a potentially greater effect among lower socioeconomic groups” and notes that modelling studies suggest this reduce the burden of type 2 diabetes, but that “evidence from empirical evaluation of the impact of SSB tax is scarce.”

“Collectively sugar-sweetened beverages are the largest source of added sugar in the diet,” the review notes. The author cites meta-analyses that found up to 12% drop in consumption after a 10% increase in price.

“Modelling studies predict this will result in a reduction in diabetes, but as yet there is no measured evidence to support this,” Associate Professor Hocking sums up the evidence to date.

“We know that body weight and diabetes are closely related and that losing weight improves blood glucose levels, and if substantial (more than 10%), can lead to remission of diabetes,” she says.

“All consumed calories contribute to body weight – sugar sweetened beverages (SSBs) are a source of calories, but not the only source. A tax on SSBs will not be the only solution to the current diabetes and obesity pandemic, but may contribute to increased health outcomes by reducing one form of easily consumed calories.”

Several surveyed GPs argued that the success of a levy would be contingent on its size.

“The cost needs to be sufficiently prohibitive to stop people drinking the stuff, but it may take many years for the benefit to flow through.”

“Anything to reduce excess sugar consumption is worthwhile,” one GP said.

“It will enforce change to reduce calorie intake via beverages, and most likely cause manufacturers to self-regulate and reduce the strength of sugar sweetened beverages,” said another.

But despite tacit support from most GPs, many aren’t convinced it will have a major impact on the epidemic.

“From the review from other countries, and all the data— not just the government-selected information to push their agenda— sugar-sweetened beverages are only a small fraction of the cause of type 2 diabetes,” one GP commented. “Maybe encourage more exercise…”

Others commented that sugar-sweetened soft drinks are not the only form of sugar contributing to obesity—and many noted concerns about the health effects of sugar substitutes.

“The risk is the use of toxic sugar substitutes. If the amount of sugar was just even lowered in beverages it would be a beneficial step.”

Others felt a more comprehensive approach is needed.

“Education is more important. The levy is a cynical tax raising measure and will impact the sugar industry (with economic flow on effects) much more than diabetes…”

“Can’t see how a sugar tax will improve peoples’ activity levels and the eating of healthy unprocessed food diets in place of over processed fast foods in an ever-increasing pace of life.”

RSV Prevention in Infants and Pregnant Women

STIs – Common and Tricky Cases

Role of Testosterone During Menopause - Evidence vs Hype

Vision and Driving Fitness: Key Insights for Health Practitioners

Yes

No

Listen to expert interviews.

Click to open in a new tab

Browse the latest articles from Healthed.

Once you confirm you’ve read this article you can complete a Patient Case Review to earn 0.5 hours CPD in the Reviewing Performance (RP) category.

Select ‘Confirm & learn‘ when you have read this article in its entirety and you will be taken to begin your Patient Case Review.

Menopause and MHT

Multiple sclerosis vs antibody disease

Using SGLT2 to reduce cardiovascular death in T2D

Peripheral arterial disease